Generations are a common topic of analysis in the insurance industry. From Baby Boomers to Gen X and Millennials, countless discussions have been had on targeting consumers with the right products and messaging.

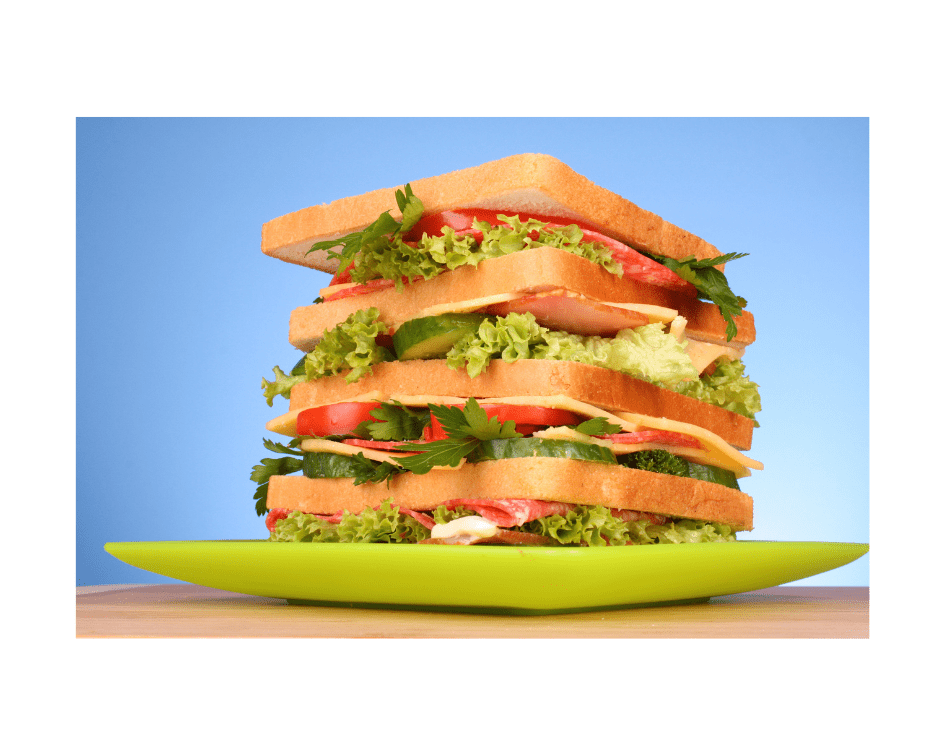

But one generation, and an extremely important one at that, has often been overlooked: the so-called “Sandwich Generation.” This generation encompasses middle-aged adults who are “sandwiched” between caring for their children and their elderly parents.

Often juggling their own finances as well as their parents’ and children’s, these adults are in desperate need of financial advice and solutions. As the ultimate connectors between family members, they are also the key to unlocking multigenerational connections for insurance advisors.

Here’s a look at the Sandwich Generation and how meeting their unique needs can help organically grow your insurance practice.

Understanding the Sandwich Generation

Unlike being a Baby Boomer or Millennial, being a part of the Sandwich Generation is more life phase than moniker set for life. Today, the Sandwich Generation includes nearly half (47%) of adults in their 40s and 50s. These adults have a parent age 65 or older and are raising a child or financially supporting a grown child.

While being a sandwich caregiver has long come with its unique rewards and challenges, the financial burdens are mounting. Older adults are living longer, and younger adults need more financial support as they increasingly seek higher education and struggle to establish financial independence. The “sandwich” is growing, and the result is an increasingly stressed Sandwich Generation.

- 80% of the generation report feeling overwhelmed, often or constantly

- 84% say that their retirement will be negatively affected by their financial responsibilities to their children and parents

- Nearly 60% expect to financially support parents as they continue to age

How to Work with the Sandwich Generation

The good news is the Sandwich Generation generally understands the need for expert financial advice and protection. When asked what would help reduce their stress, 57% chose a financial advisor as one of their top three choices. Additionally, two-thirds of the Sandwich Generation have life insurance. And of those who don’t have it, 66% said that their financial burdens as caregivers prevent them from getting coverage.

So, what does that mean for insurance advisors who want to work with this important demographic? There are a few key insights that will guide your strategy:

- Efficient, on-the-go service is required to meet their busy lifestyles

- Collaboration & relationship-building is key since they juggling the needs of multiple people

- A wide range of financial solutions should be on the table because they’re handling multi-generational responsibilities

- Engagement with other family members can help reduce the burden on sandwich caregivers

One of the best ways for insurance advisors to effectively work with the Sandwich Generation is by utilizing an insurtech platform that streamlines communication. Advisors now have access to platforms like Link by LegacyShield that act as a secure virtual workspace between clients and advisors. Clients can message their advisor when and where they need to through the platform as well as store all their important life information in its secure file-storage system.

With an insurtech platform, advisors can provide the Sandwich Generation with the on-demand advice, collaboration and file-storage capabilities that will make their lives easier and provide peace of mind.

How the Sandwich Generation Can Help You Grow

Working with the Sandwich Generation provides an excellent opportunity for advisors as well. As the nexus of their family, they will open up their multi-generational connections if they trust you. In fact, they welcome the support of a financial advisor, especially when it comes to navigating difficult conversations with their aging parents about financial or long-term care planning.

This is where the benefits of a digital workspace come into play for advisors. When a Sandwich Generation client adds their family as connected members to their account, you are empowered to connect with these family members, and they become your new sales leads.

Multi-generation connections will be key to optimizing your success in the coming years. Having them improves your chances of retaining your clients’ children as clients when they are adults, breaking the Rule of 66. It will also put you in a good position for the approaching $41 trillion Great Wealth Transfer from Baby Boomers to their descendants.

For financial and insurance advisors, the Sandwich Generation are the perfect match. They need the help of an advisor to manage the financial burdens of their family, and they can connect you with a multi-generational book of business.

To learn more about how a digital workspace benefits both advisors and clients, read our blog, “What is a Digital Workspace for Insurance Advisors?”