There’s a reason we’ve all heard that “communication is key.” Whether a relationship is personal or professional, between two people or large communities, communication is the foundation for a solid, long-lasting connection. And that’s equally true for the insurance industry. In fact, clients who regularly converse with their insurance advisors are 74% more likely to recommend their advisor to others.

Here’s why today’s tech-driven environment makes regular communication between advisors and clients more important than ever.

Why should you regularly communicate with clients?

For decades, insurance has been a low-touch industry, more transactional than relationship-based. Often, the vast majority of interaction occurred in the initial policy-buying stage. After that, communication ranged from fairly minimal to almost nonexistent. That continues to be true today with one-third of insurance customers reporting that they hadn’t heard from their provider over an entire year.

However, two major trends are making it important for insurance advisors to transition from minimal interaction to stronger client-advisor relationships:

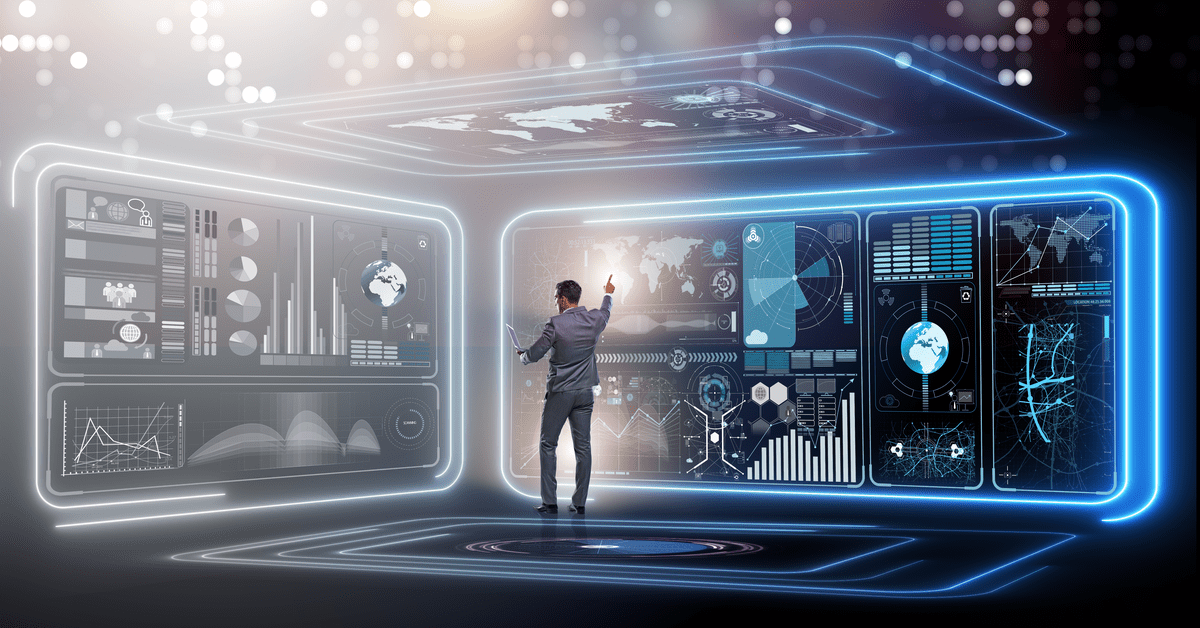

- The rise of direct-to-consumer insurtechs. These insurtechs, which offer an automated, frictionless experience, are displacing the advisor’s role as a transactional intermediary. For consumers – especially younger, tech-savvy generations – these digital newcomers are appealing because they “cut out the middleman.” What that means is that advisors need to find new ways of demonstrating their value.

- Increased demand for connectivity. The good news is that advisors have an excellent opportunity to provide greater value in an area their clients want: greater communication and connectivity. Research shows that insurance customers who have more connectivity with their provider through digital platforms have higher satisfaction rates and greater loyalty and are more likely to recommend that provider to family and friends.

While these two trends may seem contradictory, the common factor is ease of use. Consumers want to easily be able to connect with the insurance services they need, and digital technology is at the core of connection today.

Advisors who adapt to this new landscape by using digital technology to communicate and respond to clients’ needs stand to build a strong, loyal client base.

What should you communicate?

Understanding that you should consistently communicate with clients is the easy part, but what should you actually say? The right messaging can help you form great relationships and sell more products. The wrong messaging could lead to your clients ignoring you or even becoming irritated, potentially resulting in a loss of business.

The key to good communication is providing messages that are clear, concise, and relevant to your audience. For insurance providers, this is where digital tools and technology come into play. Digital platforms designed for insurance advisors, like Link by LegacyShield, offer a secure digital workspace where clients and advisors can collaborate and communicate. With this type of platform, insurance advisors gain access to advanced analytics and audience insights that allow them to better understand clients’ unique needs and communicate with them accordingly.

So, if a client views a document, responds to a message, or shares a file within the platform, the advisor receives an automatic alert. These valuable insights allow you to “listen” to your clients without having to have a meeting or phone call and identify any gaps in their knowledge or coverage. You can then recommend personalized solutions that benefit customers and increase your sales.

When should you communicate?

The timing of your message is equally important as the message itself. While regular communication is key, it’s important not to overcompensate with messaging. You don’t want to inundate your customers with constant emails, phone calls, and messages, or you may come off as “pushy” or inauthentic. Before sending a message to clients, ask yourself: “Does this add value to my client’s life?”

Again, this is where the advantage of a digital platform becomes clear. By receiving timely alerts when your clients view or work within the platform, you can better know when to reach out to clients. All communication is contained within the platform, consolidating conversations, and improving ease of access at all times.

Ultimately, the goal for insurance advisors today should be to keep an open line of communication with customers. When consistent, two-way communication exists between clients and advisors, clients know that their needs are being met and will fully trust their advisor.

To learn more about how connectivity is critical to reaching advisors’ largest customer base, read our blog, “Insurance Advisors: What You Need to Know About Millennials.”